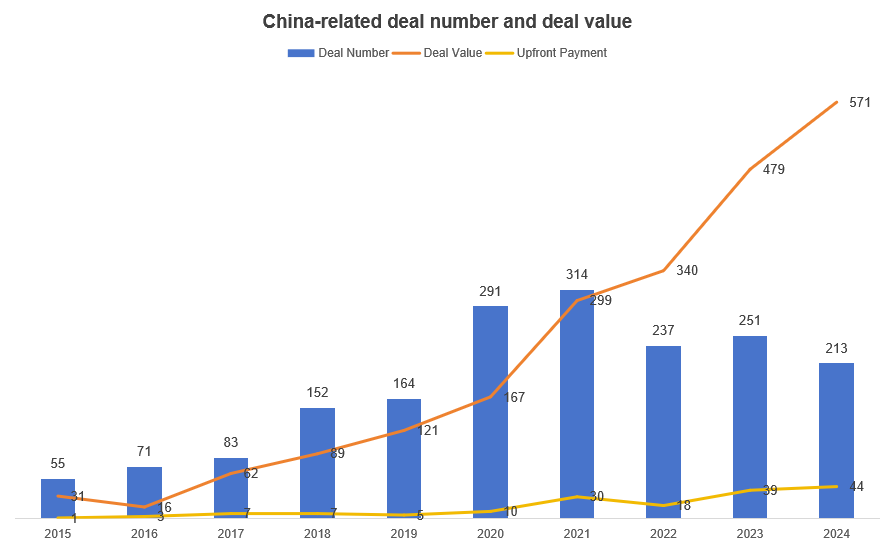

Over the past decade, China’s biotech sector has surged onto the world stage in drug licensing. From just 55 China‐related deals in 2015, Chinese biopharma companies were involved in 213 deals by 2024. Total deal value jumped from $3.1 billion to $57.1 billion, vastly outpacing the global market’s growth. Notably, Chinese firms have shifted from importing foreign innovations to exporting homegrown assets. By 2024, nearly half of China’s licensing transactions were license-out (China→world), a dramatic change from a decade earlier. This boom has been driven especially by high-value cancer therapies (antibody-drug conjugates and bispecifics), reflecting China’s maturing R&D and global demand for new drugs.

Source: NextPharma Database

License-In vs License-Out: China Joins the Innovation

In the mid-2010s, Chinese biotechs heavily relied on license-in to fill their pipelines. Top companies like BeiGene and Zai Lab inked large deals to import approved or late-stage oncology drugs from abroad. For example, global giants were the main licensors (~50%), and about 40% of China’s licensed-in projects were small-molecule drugs focusing on cancer. In recent years, these license-in deals have declined: by 2024, only 41 license-in deals were recorded, with many now involving already-approved drugs. This reflects China’s maturing R&D capabilities.

By contrast, license-out (outbound) has become China’s dominant mode. Since 2020, there has been a frenzy of China-origin deals with foreign partners. In 2024 alone, Chinese firms out-licensed 94 projects to overseas companies – a remarkable turnaround. The typical license-out now looks like this: Chinese biotech grants global development rights to its novel asset in exchange for upfront payments, milestones and royalties. Often, the rights are global or cover major markets (outside China), while the Chinese company retains Greater China rights. Oncology leads (e.g., novel ADCs, bispecifics), but we now also see deals in immunology and neurology. Importantly, many of these Chinese-origin assets are still in early clinical stages – companies are “going big” on earlier projects and sharing development risk with global partners. This is a clear reversal: Chinese firms now export innovative pipelines instead of importing them.

License-out deals in China emphasize earlier-stage, high-tech assets (e.g., ADCs, bispecific antibodies) in global markets. By contrast, license-in deals focused on mature drugs. This shift shows China is contributing more innovation.

Explosive Growth in Deal Volume and Value

Chinese drug licensing deals have grown at double-digit rates. From 2015 to 2024, the total deal count in China roughly quadrupled (55 to 213 deals), while total deal value leaped nearly 18-fold. This far outstripped global deal growth (global deals rose 358→743 and $56.9 B→$187.4 B in the same period. Recent years saw record-breaking figures: GlobalData reports that the value of Chinese biopharma licensing deals surged 66% year-over-year in 2024 (from $16.6 B in 2023 to $41.5 B in 2024). In H1 2025 alone, U.S. companies signed 14 China-licensed deals (worth ~$18.3 B) compared to just 2 such deals in H1 2024.

These headline numbers hide even more dramatic trends in specific categories. For example, licensing of monoclonal antibodies from China jumped 43% to $11.3 B in 2024, and ADC deals grew to $10.0 B. Moreover, as China’s innovative pipeline filled, the count of large deals has exploded: one report notes that 19 ADC deals in the past decade each exceeded $1 B. Over 2020–24, the number of major licensing-out deals (>$1B) involving Chinese licensors rose sharply. In sum, Chinese drug licensing is moving from niche to mass scale, both in the number of deals and aggregate value.

The Emerging NewCo Model for Licensing Deals

A defining trend in recent Chinese deals is the “NewCo model.” In essence, a Chinese pharma spins out one or more clinical assets into a newly formed offshore company (the NewCo) alongside international investors. The Chinese licensor contributes drug assets/IP to the NewCo in exchange for cash and equity in the NewCo, while investors fund development. In practice, this means the deal combines a license-of-rights with an equity investment in the JV – merging two traditional BD approaches into one package.

According to Morgan Lewis, the NewCo model “spins off certain clinical assets and partners with investors to refinance the development of those assets through the creation of a new company”. It’s akin to a strategic divestiture plus joint venture: Chinese companies get upfront funding and still own a stake in future upside. The investors (often the U.S./European venture or pharma firms) get rights to develop and sell the assets worldwide. By using an offshore NewCo (often the US or other biotech hub jurisdiction), parties avoid Chinese foreign-direct-investment hurdles and foreign-exchange approvals that hamper straight equity transactions.

Why is NewCo popular now? In a slowing capital environment, Chinese firms want funding for R&D and a path to reward if their assets succeed. The NewCo lets them raise cash indirectly: for example, Hengrui received ~$113 M of its $110 M license fee as equity in the JV. This lowers the upfront cash burden on investors while giving Chinese licensors “a long-term ticket” to growth. It also preserves high-value domestic pipelines by spinning them off, letting the parent focus on core programs. For investors, NewCos are attractive vehicles to tap Chinese innovation without direct onshore deals.

From the Chinese companies’ perspective, NewCo deals “supplement cash flow/obtain equity in a short period while retaining partial rights to the products”. If the program is later bought or IPO’ed, the Chinese partner still enjoys milestone/royalty and equity appreciation. Western investors and Big Pharma, meanwhile, share development risk and gain a stake in promising Chinese-origin drugs.

China Biotech Stocks Have Beaten Tech Peers in Past Year

From January to the present, fueled by investor enthusiasm for multibillion-dollar deals involving foreign companies licensing innovative Chinese drugs, the Hang Seng Biotech Index has surged more than 60%. This rally has even outpaced the 17% gain in Chinese tech stocks, which was driven by the breakthrough AI application released by DeepSeek in January.

China’s biotech industry is no longer just an emerging sector—unlike a decade ago, it has now become a disruptive force reshaping the global landscape of pharmaceutical innovation.

Source: Bloomberg

According to Bloomberg, a major driver behind the stock surge is two mega licensing deals. On May 19, Pfizer announced it had agreed to pay a record-setting $1.25 billion to license a PD-1/VEGF bispecific antibody from Transcenta, along with a $100 million equity investment in the company. Two weeks later, BMS revealed a deal worth up to $11.5 billion with BioNTech to acquire rights to a PD-L1/VEGF bispecific antibody—an asset BioNTech had originally licensed from DualityBio in 2023.

Bloomberg described the rally in biotech shares as “stunning”: Transcenta’s stock soared 283%, ranking first among all biotech stocks globally tracked by Bloomberg. Rongchang Bio also saw its shares jump more than 270% after announcing that multiple multinational pharmaceutical companies had approached it for potential licensing deals.

This wave in Chinese innovative drugs is not an isolated phenomenon—it is resonating with the broader resurgence of interest in Chinese equities globally. From a macro perspective, international capital is returning to China, and the strong performance of China’s stock market this year is expected to attract even more global capital inflows.

Drivers of China’s Drug Licensing Boom

Multiple structural factors fueled this boom. In China, sweeping regulatory reforms since 2015 transformed the ecosystem. The “7.22” review (2015) cleaned up thousands of old trial applications, and new laws (2015, 2017) streamlined reviews and introduced the MAH (Marketing Authorization Holder) system. These policies sped drug approvals, aligned standards with international norms, and shifted the industry from “production-driven” generics to true R&D innovation. In tandem, massive investment flowed into biotech. Chinese biotechs raised tens of billions via IPOs and venture rounds; for example, their combined market cap soared from about $3 B in 2016 to ~$380 B by 2021. This capital, along with a “reverse brain drain” of overseas-trained scientists, built deep R&D teams.

Globally, demand for innovative assets also spurred China’s licensing boom. Western pharma giants face looming patent cliffs (Merck’s Keytruda is a famous example) and a need to replenish pipelines. Chinese companies began offering high-quality candidates at relatively attractive prices: analysts note that Chinese drug candidates often come “at prices much more affordable” than comparable U.S.-origin assets. Chinese government support and efficient trial systems have also made China an appealing licensing source. One industry report highlights that faster, lower-cost clinical trials and improved drug quality in China have made out-licensing deals “cost-effective” for global partners. In short, regulatory overhaul, expanded R&D capacity, plentiful capital, and surging global demand combined to create a perfect storm for Chinese drug licensing activity.

Key structural drivers include:

- Regulatory reform and policy support: Aggressive 2015–2020 reforms (new drug laws, MAH, priority review) improved China’s R&D environment.

- R&D capacity and talent: Hundreds of experienced researchers have returned to China, and biotech platforms have matured, especially in oncology and biologics.

- Capital and industry funding: Booming VC and IPO activity pumped resources into startups; for instance, Chinese biotech market value grew ~100 times in a few years.

- Global pharma demand: Western companies increasingly license Chinese assets to meet unmet needs (oncology, immunology, etc.) and offset lost revenue.

Global Trends: China vs. the World

China’s licensing boom plays out in a broader international context. The U.S. and China now dominate global pharma deal activity. By deal count both countries have been the top two transaction parties this decade. China’s share of global drug R&D has surged – from only 2–4% a decade ago to roughly 25–30% today. (By comparison, the U.S. share is declining slightly – around 36–48% by different measures.) Asian markets and multinationals are paying attention: companies like Novo Nordisk, Merck, AstraZeneca, and Pfizer have all signed high-profile deals with Chinese biotech in recent years.

In terms of raw deal-making, U.S. firms have dramatically stepped up in-licensing from China. For example, in the first half of 2025 U.S. pharma inked 14 China-sourced licensing agreements (worth ~$18.3 B), compared with only 2 such deals in the same period of 2024. This mirrors a broader global trend: one analysis finds that Chinese companies supplied roughly 28% of large pharma’s in-licensed new drugs in 2024. In biotherapeutics specifically, 2024 saw China-originated monoclonal antibodies and ADCs making up significant slices of the pipeline. China now leads the world in clinical trials initiated (39% of new trials in 2023 included a Chinese site), signaling its labs produce a huge share of tomorrow’s drug candidates.

In short, while the U.S. remains a giant in biotech, China’s relative footprint in drug development and licensing has exploded. Companies globally recognize that neglecting China’s innovation engine carries risk. As one expert put it: China now offers “a dizzyingly abundant source of innovative, high-quality therapies” at competitive prices.

Strategic Insights

For Chinese biotech companies, the key is to use licensing creatively without losing sight of core value. The NewCo model is a powerful tool to raise capital and globalize assets, but companies should:

Retain Meaningful Equity/Control: Negotiate NewCo terms so that equity and rights match asset value. Getting a double-digit percentage ownership (as Hengrui did) ensures ongoing influence.

Protect IP and Escalators: Structure milestones and royalties carefully. Retaining Greater-China rights (as Kelun and RemeGen did) allows catching home-market upside, while licensing global rights.

Vet Partners: Choose investors or partners with relevant expertise and long-term commitment. The track record of the JV team (Kailera’s Bain/Atlas backing, etc.) matters.

Plan Exit Strategy: Decide in advance if the goal is IPO, sale, or spun integration into a pharma portfolio. The equity stake allows Chinese firms to participate either way.

For international pharma or investors, these trends open new opportunities:

Access Innovation Efficiently: NewCo deals let Western firms license Chinese science with modest upfront capital. Instead of acquiring minority stakes in Chinese cos or co-developing from scratch, a global fund can back an offshore JV to capture multiple assets (as in the Hercules and Belenos examples).

Diversify Pipeline: Chinese startups often tackle targets (e.g., novel ADC payloads, bispecifics) that big pharma also wants. By co-investing in NewCos, Western players hedge early-stage risk while securing a priority window on assets.

Simplified Structuring: Working through offshore NewCos avoids Chinese regulatory entanglements. It also creates an attractive package for cross-border investing (no need to qualify as FDI).

Governance Vigilance: However, foreign partners must insist on robust legal frameworks (IP warranties, exit triggers). As DrugTimes notes, challenges include “equity distribution games” and cultural integration in these joint ventures. Due diligence on on-target probability (given 40% drop-out rates) is also crucial.

Key Takeaways: China’s drug licensing boom means unprecedented global collaboration. Chinese firms are no longer just technology seekers; they are now innovation exporters, often via complex NewCo deals. Biotech professionals should therefore be alert to China-origin assets and flexible deal structures. In practice:

Monitor Outbound Pipelines: Watch Chinese biotech conferences and filings for high-potential assets (many are now intent on global development).

Leverage NewCo Structures: Consider hybrid equity+license partnerships to balance risk and reward (both sides get skin in the game).

Focus on Win-Win: Align incentives so Chinese innovators and global investors share the upside. Clarify milestones, royalties, and equity splits up front.

Conclusion: China’s New Role in Global Drug Licensing

In this evolving landscape, cross-border licensing is no longer a one-way street. Chinese and international companies can each benefit: Chinese firms gain capital and global reach, while Western partners tap fresh innovation. By understanding the trends above – and learning from case studies like Hengrui, Kelun, I-Mab, Junshi, RemeGen, Keymed, and Genor – biotech leaders can craft smarter licensing strategies. In the words of a recent review, these “NewCo” transactions are positioning China at the forefront of global pharmaceutical innovation. Success will go to those who blend China’s inventive assets with robust partnership structures, aligning technical ambition with financial and strategic foresight.

If your business is planning to go global, our team at EC Innovations can help you localize effectively. Contact us to explore global solutions tailored to your local markets.